Elliott’s Plan to Streamline Phillips 66

Your Vote Matters

Vote Your Shares Today

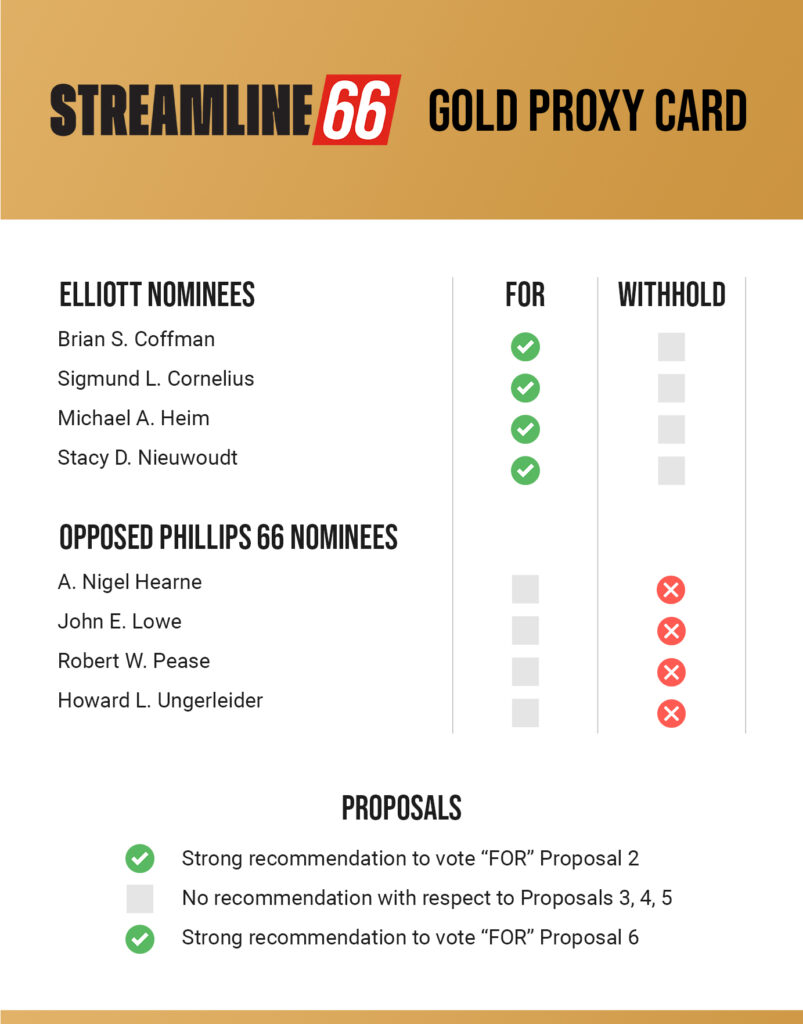

The Annual General Meeting of Phillips 66 (the “Company”) shareholders is scheduled to be held virtually on May 21, 2025. You can vote your shares using one of the voting options listed below. Elliott urges you to use the GOLD universal proxy card or voting instruction form.

Elliott’s Letter to

Phillips 66 Shareholders

Dear Fellow Phillips 66 Shareholder:

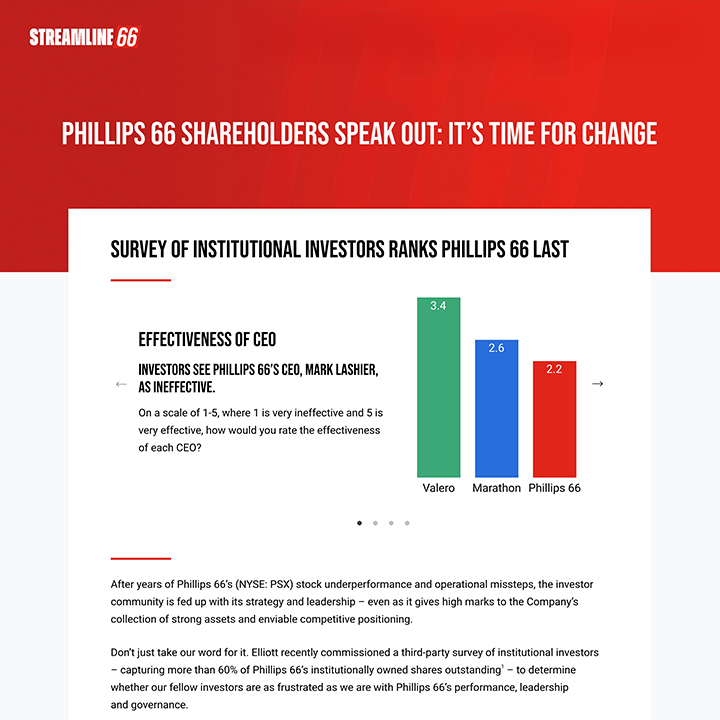

We are writing to you as fellow investors in Phillips 66 (NYSE: PSX) (the “Company”), an energy conglomerate that is falling well short of its potential and is in urgent need of a new direction.

We believe that with resolute and decisive action, Phillips 66 is primed to deliver far greater returns for its shareholders than it has over the past decade. The purpose of this letter is to seek your support for an upgraded Board of Directors that is committed to achieving the performance that shareholders demand and deserve. Your vote on the enclosed Gold Card will set in motion a clear plan to improve Phillips 66’s operating performance, strengthen Board accountability and increase the value of your investment.

Elliott’s Streamline 66 Presentation

February 11, 2025

Nominees

Elliott has nominated four highly qualified candidates with best-in-class experience in refining and midstream operations, capital allocation and complex transactions. Elliott’s director nominees are as follows.