Phillips 66 Shareholders Speak Out: It’s Time for Change

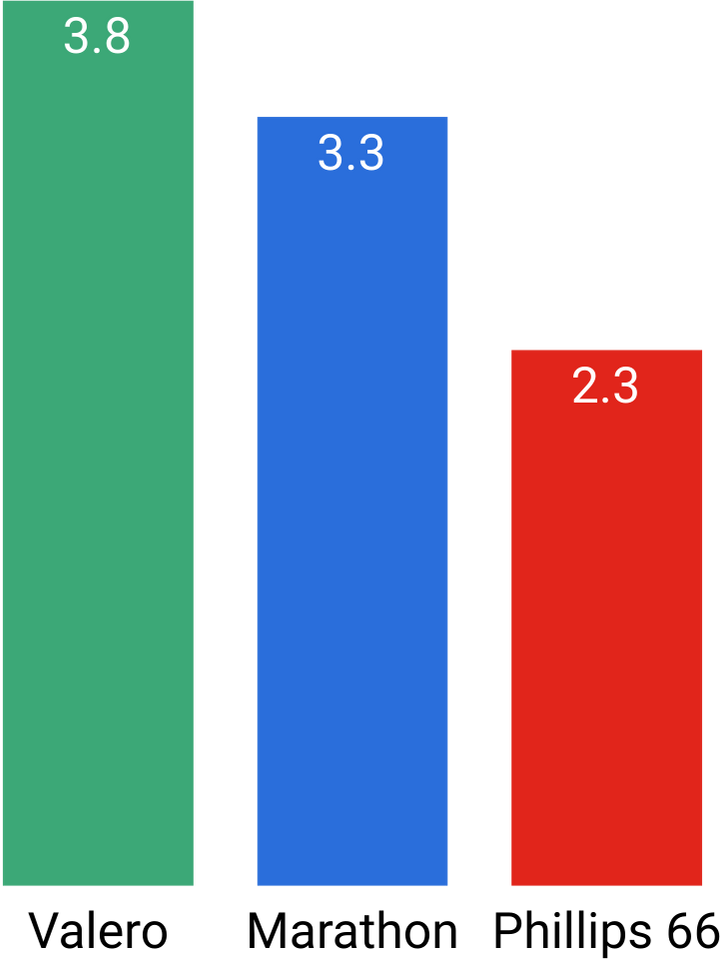

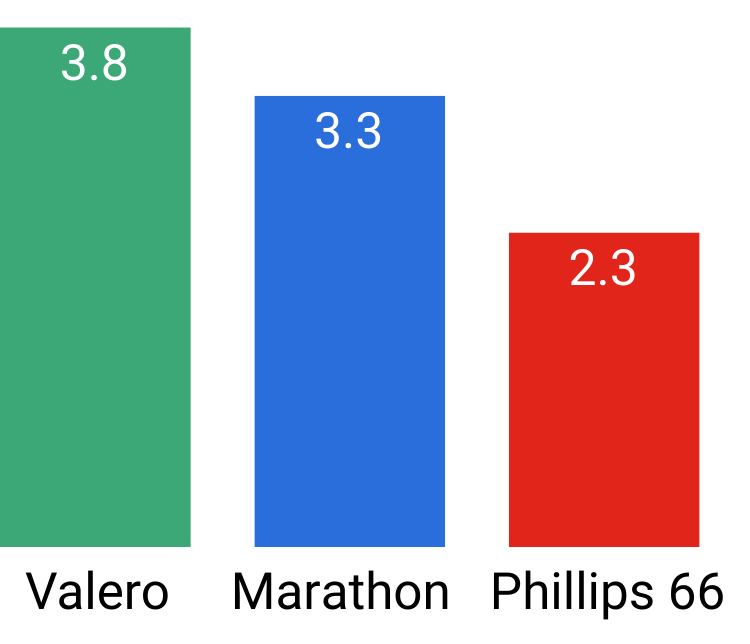

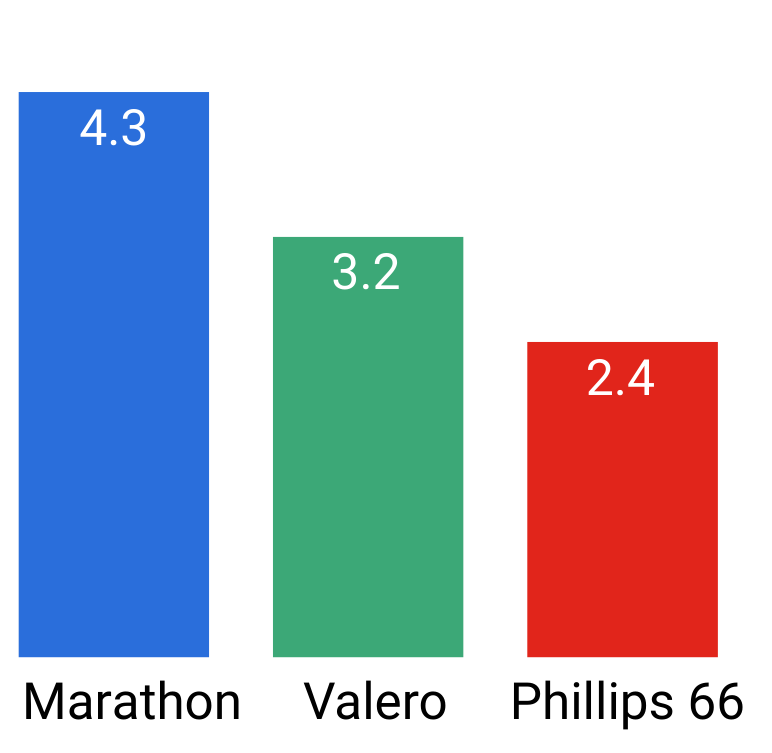

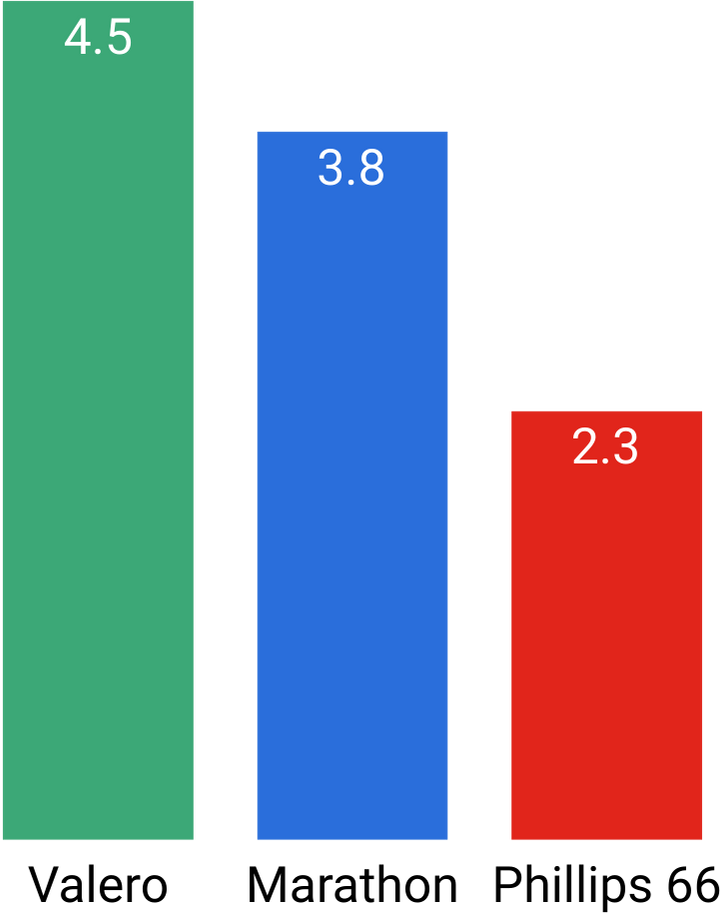

Survey of Institutional Investors Ranks Phillips 66 Last

After years of Phillips 66’s (NYSE: PSX) stock underperformance and operational missteps, the investor community is fed up with its strategy and leadership – even as it gives high marks to the Company’s collection of strong assets and enviable competitive positioning.

Don’t just take our word for it. Elliott recently commissioned a third-party survey of institutional investors – capturing more than 60% of Phillips 66’s institutionally owned shares outstanding1 – to determine whether our fellow investors are as frustrated as we are with Phillips 66’s performance, leadership and governance.

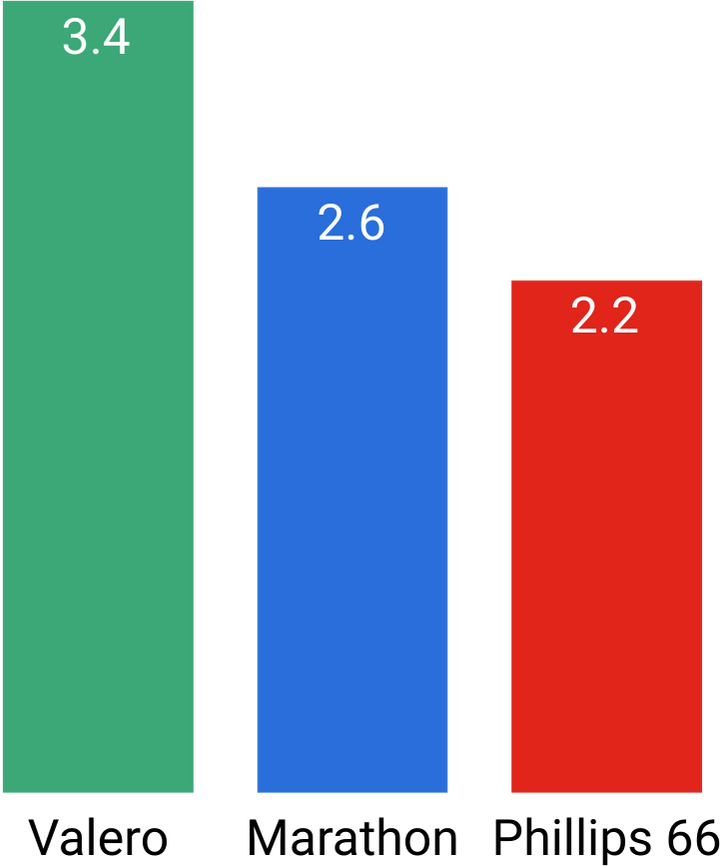

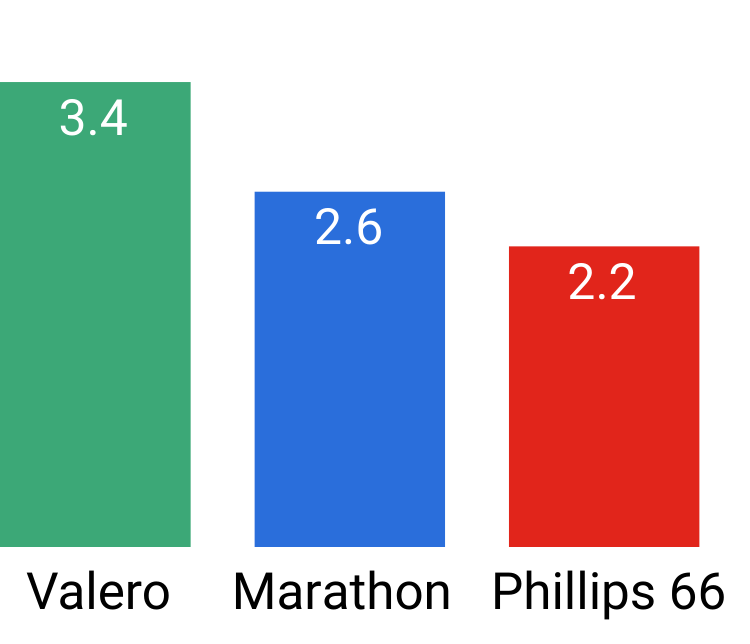

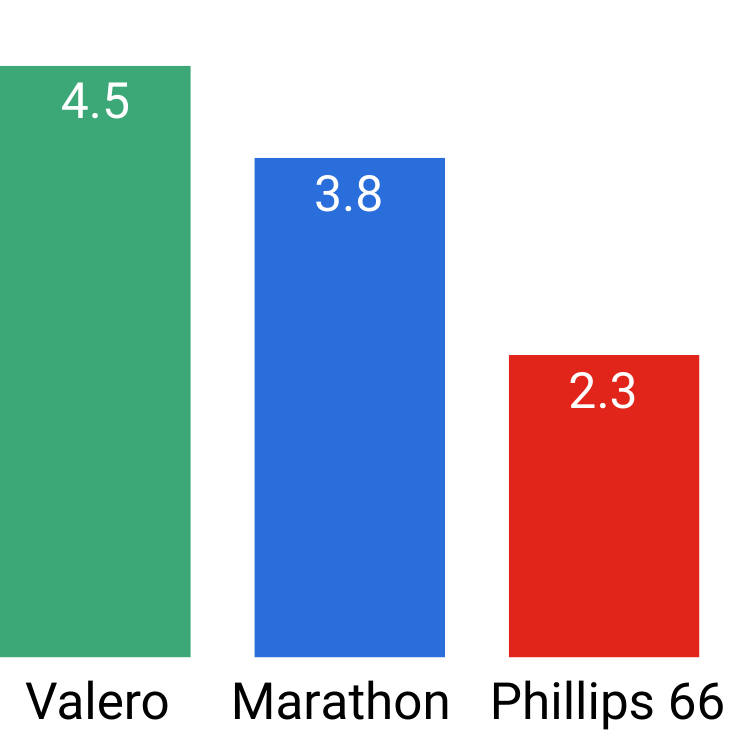

They are. The survey found that investors rank Phillips 66 last among its peers on operational execution, CEO effectiveness, capital-allocation strategy and overall delivery against its value-creation agenda. These challenges are reflected in the Company’s share price, which has lagged its closest peers Valero Energy and Marathon Petroleum by -138% and -188%, respectively, over the past decade.2

Elliott has a clear plan to simplify Phillips 66’s inefficient conglomerate structure and unlock trapped value not reflected in the stock price today. Our “Streamline 66” plan calls for the Company to sell or spin off its midstream business and non-core assets to focus on refining. A thorough review of refining operations would help restore cost discipline and the best-in-class performance that Phillips 66 was once known for.

Shareholders say they’re frustrated with Phillips 66’s underperformance and management’s failure to hit their financial and operational targets, despite repeatedly claiming success.

Investors clearly support bold action at Phillips 66. They need results, not more empty rhetoric:

Investors See Potential, But the Right Plan Needs the Right People

Elliott sees a path to a significantly higher Phillips 66 share price – but Company leadership needs to act. Unfortunately, shareholders doubt the current Board and management team’s appetite or ability to do what needs to be done. This leadership deficit detracts from otherwise positive perceptions of Phillips 66 and the assets in its portfolio. Investors like what’s under the hood and see potential for substantial gains from Phillips 66 stock.

The “Streamline 66” plan calls for adding new independent directors to Phillips 66’s Board to help strengthen accountability and reverse the Company’s underperformance. Elliott and other investors’ positive view of Phillips 66’s potential seems at odds with views expressed by the Company’s own management, which has talked down the value of the stock and repeatedly defended a broken status quo.

Former energy investor and independent GOLD proxy card nominee Stacy Nieuwoudt summed it up on a recent episode of the “Streamline 66” podcast:

“Investors have been overwhelmingly supportive of this campaign…I’ve been covering the [energy industry] for over 20 years, I’ve attended thousands of meetings with management teams. I’ve never had a management team suggest to me that their stock was fully valued. That just inherently highlights the disconnect between the investor mindset and the management.”

– Stacy Nieuwoudt, Streamline 66 Podcast

1Third-party survey conducted as of March 2025. Percentage based on analysis performed by Elliott’s proxy solicitation firm, equivalent to 44.3% of total outstanding shares.

2Total Shareholder Return per Bloomberg, ending on 2/7/25.

Note: Emphasis added in quotations.

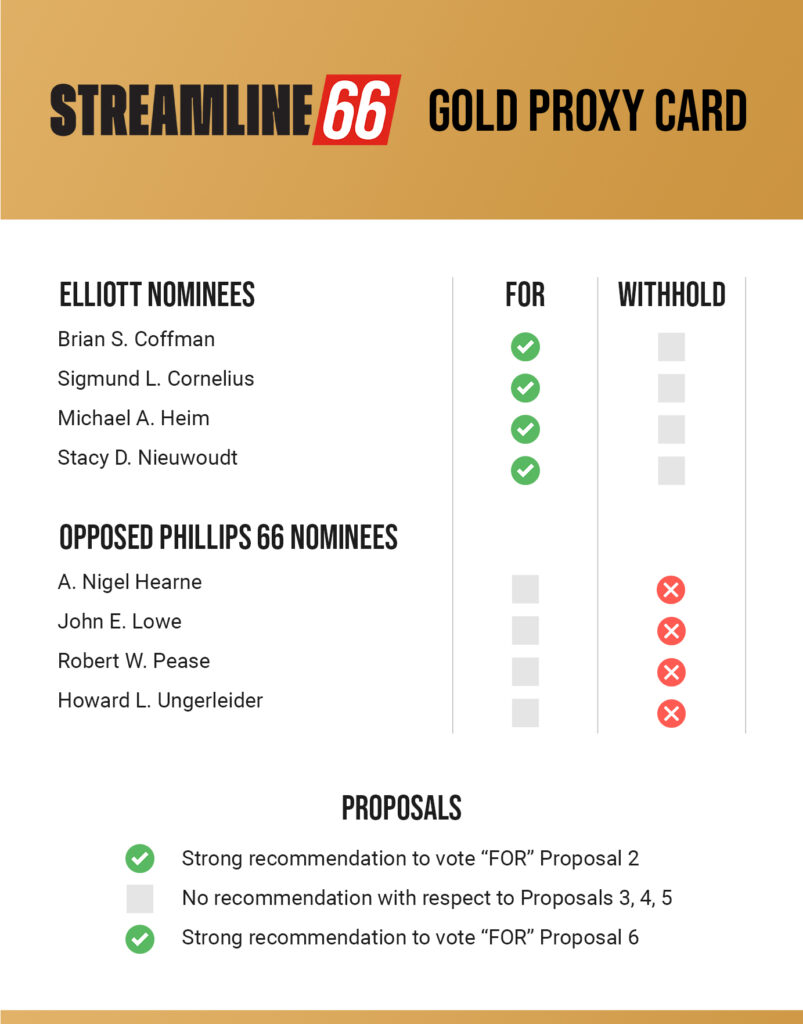

The path forward

Shareholders can act today by voting on the GOLD proxy card to elect all four of Elliott’s nominees to the Phillips 66 Board of Directors. Stacy Nieuwoudt, Brian Coffman, Sigmund Cornelius and Michael Heim would bring urgently needed expertise, new perspectives, and a willingness to enact bold changes to the Company’s boardroom.