Energy Veteran Goff Backs Streamline 66 Plan

Makes $10M Personal Investment in Phillips 66, Offers Expertise and Assistance

Respected industry veteran Gregory Goff, who spent decades at ConocoPhillips and led a highly successful turnaround while CEO of Andeavor, has publicly shared his support for Elliott’s value-creation plan at Phillips 66.

Rather than welcome the involvement and expertise of one of the pre-eminent energy executives of our time – and a large shareholder – Phillips 66 greeted the news of Mr. Goff’s investment in its stock and his support for our campaign by immediately and angrily impugning his motives and questioning his integrity. The Company went even further with its attacks on Mr. Goff, publicly claiming a conflict of interest where none exists, and privately spreading rumors that he must be receiving compensation from Elliott, which is false. Other than reimbursing expenses related to our joint evaluation of investment opportunities, Elliott has never paid Mr. Goff a cent – including for anything related to Phillips 66.

Mr. Goff’s more than 40 years of experience includes nearly three decades at ConocoPhillips (Phillips 66’s predecessor company), nearly a decade as CEO of refiner Andeavor (formerly known as Tesoro), and service on the Exxon Mobil Board of Directors. At Andeavor, Mr. Goff spearheaded one of the industry’s most successful financial and operational transformations, presiding over a 1,200% increase in shareholder returns relative to the Energy Select Sector SPDR Fund (NYSE: XLE). During our joint evaluation of private refining opportunities, we have witnessed firsthand his impressive ability to identify and develop a clear value-creation plan – experience that will be invaluable as we push for change at Phillips 66.

Why seek to discredit a prominent shareholder and former energy executive for voicing concerns about the Company’s direction?

To us, it appears that the real reason Phillips 66 rebuffed Mr. Goff has nothing to do with his independence from Elliott, and everything to do with his independence from CEO Mark Lashier and the Company’s Board of Directors.

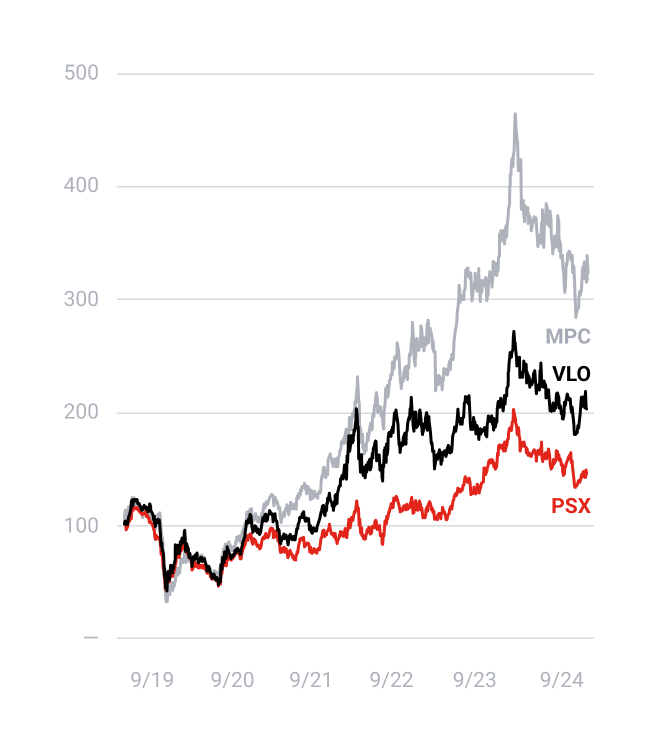

This experience is emblematic of the need for change in the Phillips 66 boardroom. Not only have the Company and its stock badly underperformed in recent years under this leadership team, but the level of engagement with shareholders and openness to new ideas has been severely lacking.

Source: Bloomberg as of February 7, 2025.

Elliott has been attempting to work constructively with Phillips 66 since late 2023, while the Company has waged a campaign to misinform its investors and the public about its performance and value of its assets, all in the interests of maintaining a flawed status quo and protecting entrenched management.

This is not normal: Elliott has a long history of constructively engaging with U.S. company boards to create shareholder value, having collaborated with more than 100 companies over the last 15 years to create shareholder value. In that time, it has only reached the definitive stage of a U.S. proxy contest three times before now.

Phillips 66’s latest move – maligning the reputation of a widely respected energy-industry executive for having the temerity to criticize the Company’s strategy – is a telling reflection of the urgent need for reform. As Mr. Goff said in a statement on April 9, “Phillips 66 has lost its way.”

Elliott welcomes Mr. Goff’s support

Elliott is pleased to have the support and assistance of Mr. Goff for its Streamline 66 campaign, which calls for simplifying Phillips 66’s conglomerate structure, refocusing on achieving refining excellence and adding new independent directors to the Board. His experience could be invaluable to Phillips 66 as it works to regain its status as an industry leader.

It is clear that Phillips 66’s current leadership is either unwilling or unable to enact the bold changes required to set the Company back on track. Elliott has nominated four highly qualified candidates for shareholders to consider at the upcoming Annual Meeting.

Phillips 66 Shareholders deserve better.

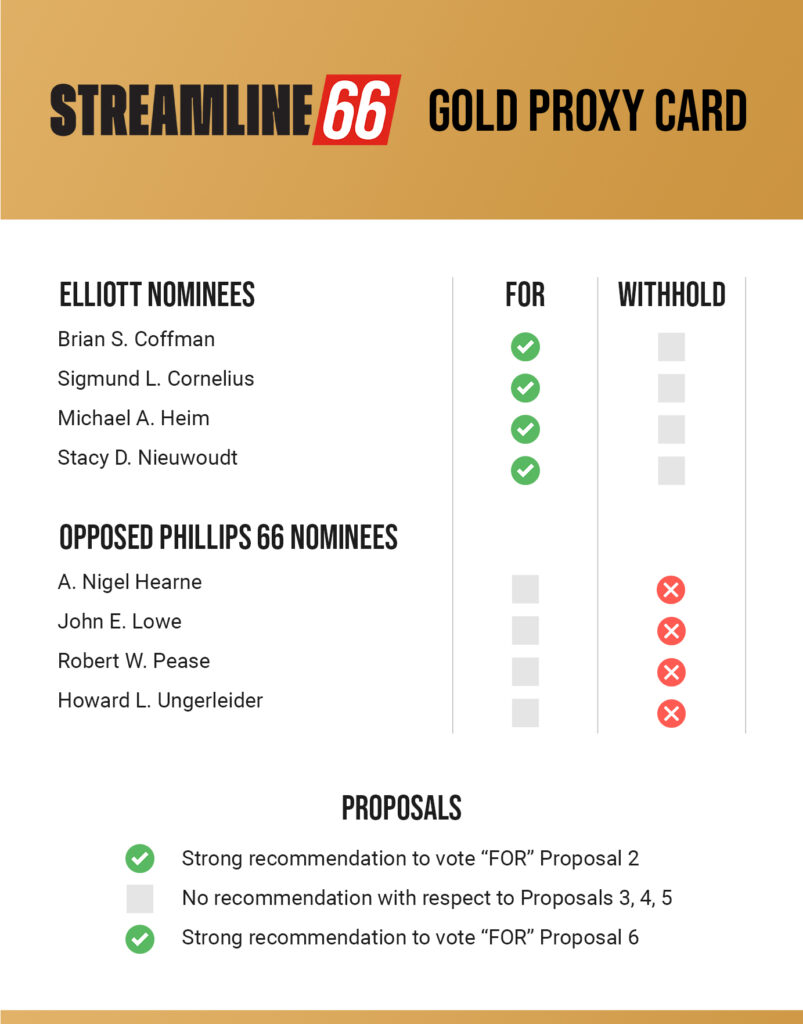

Phillips 66’s Annual Meeting is scheduled to be held virtually on May 21, 2025. We strongly urge you to vote the GOLD card FOR Elliott’s outstanding slate of director nominees, and FOR our proposed corporate governance enhancements.

You can vote your shares using one of the voting options listed at the link below.