Sandbagging? Or a Broken Business Model?

Phillips 66’s first-quarter earnings report on April 25 comes amid a long, frustrating period of underperformance versus its peers. Institutional investors say they’re fed up with leadership’s flawed strategy and poor operational execution, according to a recent survey.1 Now, under pressure to deliver, management appears to be lowering expectations.

The first quarter of 2025 is likely to prove an unfortunate continuation of the status quo. Phillips 66’s results are expected to be underwhelming, either exposing a breakdown in operations and the complete failure of the company’s integrated business model – or showing that the company may be deliberately downplaying performance. If the consensus estimates for Phillips 66’s results are indeed accurate, they suggest that the company’s conglomerate structure provides no meaningful value to shareholders or insulation from severe fluctuations in earnings.

If You Can’t Improve Results, Lower Expectations?

Typically, executives at major companies meet with Wall Street research analysts covering their stocks ahead of quarterly earnings reports. It’s a chance to update analysts on the quarter, informing the earnings previews they publish for their investor clients.

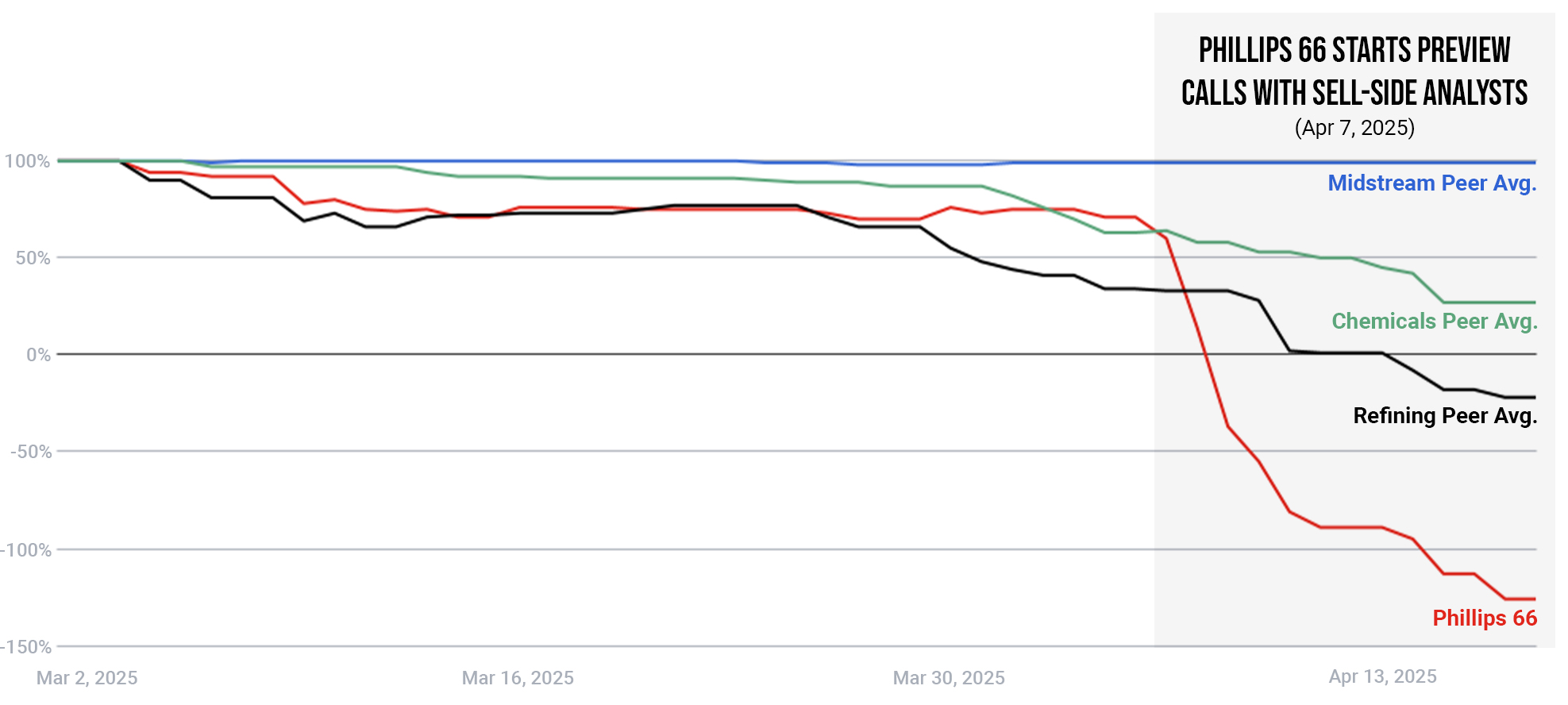

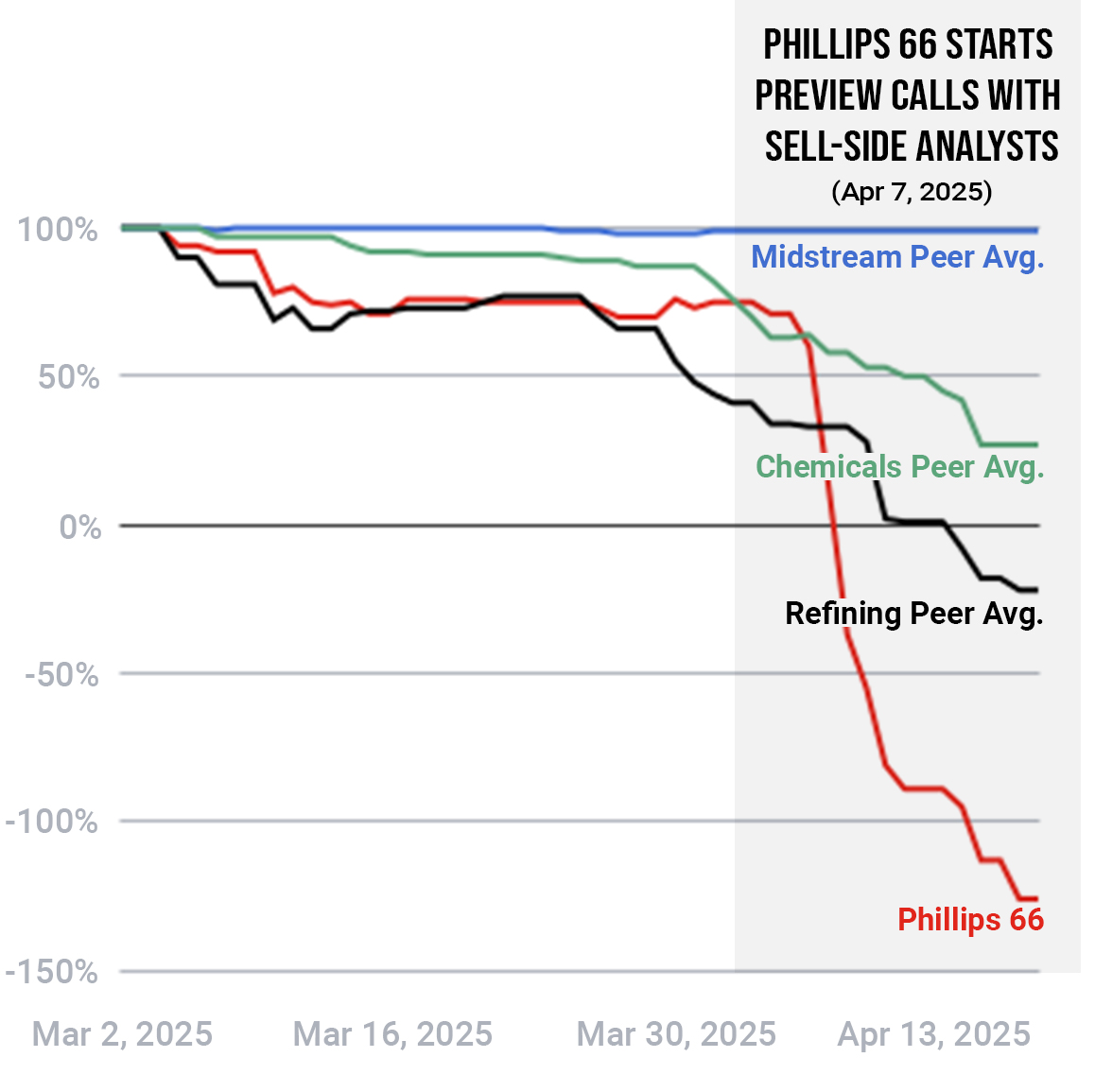

Since Phillips 66 began hosting preview calls with analysts during the first week of April, the consensus estimate for its first-quarter earnings per share has tumbled – suggesting that management is aggressively talking down expectations for the quarter. Analysts have responded by lowering their earnings forecasts. Meanwhile, EPS estimates for Phillips 66’s peers have declined significantly less during the same period.

Q1 2025 Consensus EPS Revisions

Source: Bloomberg as of April 16, 2025. Normalized to 100% as of March 2, 2025.

Note: Refining Peer Avg. reflects the average of MPC and VLO. Midstream Peer Avg. reflects the average of TRGP, EPD, MPLX and OKE. Chemicals Peer Avg. reflects the average of DOW and LYB.

Is Phillips 66 leadership lowballing expectations? Or does the negative guidance indicate a deeply disappointing quarterly report to come? Either scenario underscores the need for a meaningful change at Phillips 66.

More Accountability. Less Rhetoric.

Phillips 66 management shouldn’t expect applause for lowering—and then beating—expectations while its competitors outperform. And if results are in fact as poor as management appears to be indicating to analysts, the case for leadership, operational and strategic change becomes even stronger.

Shareholders should approach Phillips 66’s upcoming quarterly report with an extra dose of scrutiny. Don’t be fooled by an entrenched leadership team continuing to claim success in the face of weak results.

1Third-party survey conducted as of March 2025. Percentage based on analysis performed by Elliott’s proxy solicitation firm, equivalent to 44.3% of total outstanding shares.

Vote For Change Today

Your vote matters, regardless of how many shares you own. Phillips 66’s annual meeting is scheduled to be held virtually on May 21, 2025. We strongly urge you to vote the GOLD card FOR Elliott’s outstanding slate of director nominees, and FOR our proposed corporate governance enhancements.